Framework

Project Technology:

Developers,

Owners Representatives,

Architects,

Engineers,

General Contractors,

Brokers,

Capital Markets Groups,

Consultants,

Advisors,

Developers, Owners Representatives, Architects, Engineers, General Contractors, Brokers, Capital Markets Groups, Consultants, Advisors,

1: Project feasibility

2: Project validation

3: Project launch

4: Project execution

5: Project stabilization

6: Project optimization

Framework is a fully integrated execution suite designed to streamline built-world projects for developers and project teams, delivering 80% of essential project management functions with just 20% of the tools. By centralizing key workflows—ranging from initial feasibility and financial structuring to project validation, contract execution, and construction oversight—Framework eliminates inefficiencies, reduces risk exposure, and uncovers opportunities that would otherwise go unnoticed. With built-in tools for tracking scope, schedule, budget, and market conditions, teams can make faster, smarter, and data-driven decisions at every stage of the project lifecycle. The suite simplifies complex processes like capital stack management, procurement, and stakeholder coordination, ensuring seamless alignment across ownership, investors, consultants, and contractors. Its dynamic validation system continuously refines project assumptions, de-risking execution while maintaining real-time adaptability to market shifts. By automating critical administrative and financial workflows, Framework significantly cuts overhead costs while accelerating project timelines. Unlike fragmented solutions that require multiple platforms, Framework is a one-size-fits-all execution engine that brings clarity, efficiency, and strategic oversight to every development, keeping projects on track, on budget, and primed for long-term success.

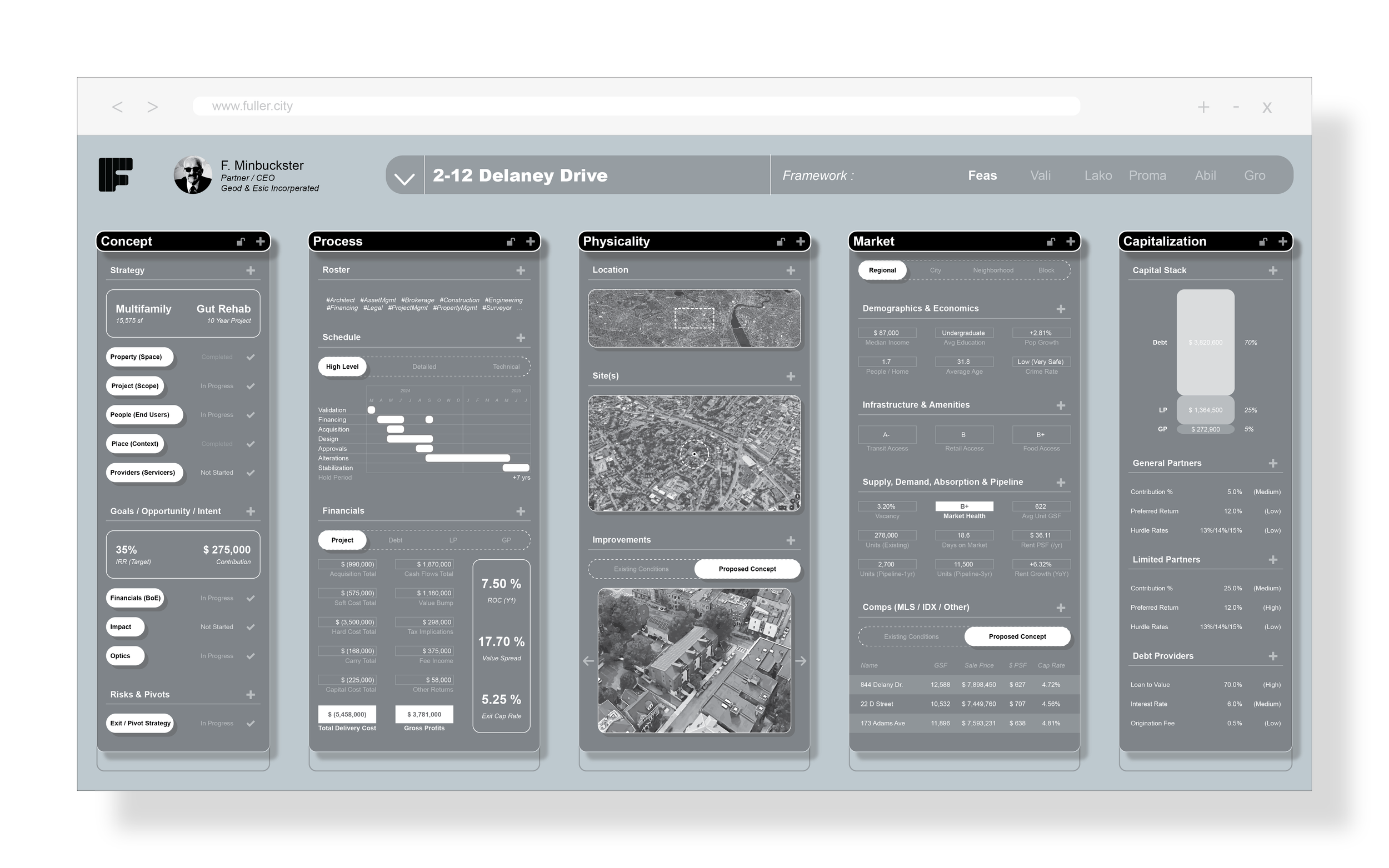

Feas

Project Feasibility

Test project viability with data-driven financial, market, and risk assessments.

Feas ensures every project starts on solid ground by analyzing scope, financials, and market conditions before execution. With tools for budgeting, scheduling, and risk evaluation, you gain the confidence to move forward with investments that are feasible, profitable, and strategically sound.

Vali

Project Validation

Eliminate project risk by stress-testing scope, budget, and execution plans.

Vali ensures your project is airtight by validating financial assumptions, delivery methods, and team readiness before execution. With sensitivity analysis, stakeholder input, and strategic oversight, you can de-risk investments, refine strategies, and move forward with total confidence.

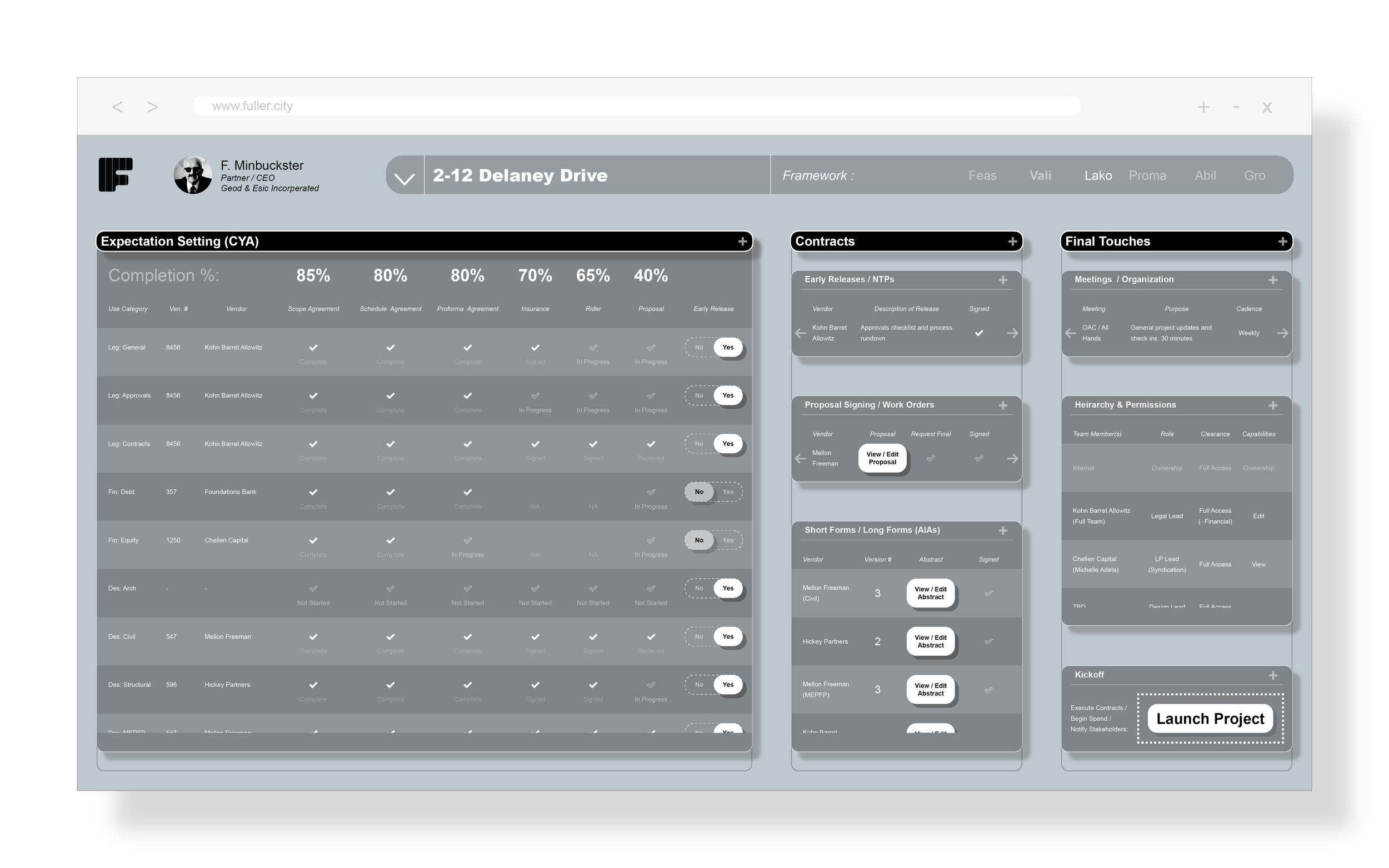

Lako

Project Launch & Kick Off

Ensure every project starts with alignment, accountability, and execution readiness.

Lako sets the foundation for success by securing stakeholder commitments, finalizing contracts, and structuring project workflows. With clear expectations, organized onboarding, and role-based permissions, your team is fully equipped to execute seamlessly from day one.

Proma

Project Execution

Keep projects on track, on budget, and optimized for success.

Proma centralizes project oversight, tracking scope, schedule, financials, and risk in real time. With dynamic tools for team coordination, progress monitoring, and budget control, you gain complete visibility—ensuring seamless execution and maximum efficiency from start to finish.

Abil

Project Stabilization

Ensure a smooth transition from project completion to full occupancy.

Abil streamlines the lease-up and sell-off process, tracking unit absorption, onboarding tenants, and finalizing operations. With integrated marketing, sales, and turnover tools, it ensures assets stabilize quickly, efficiently, and with maximum return on investment.

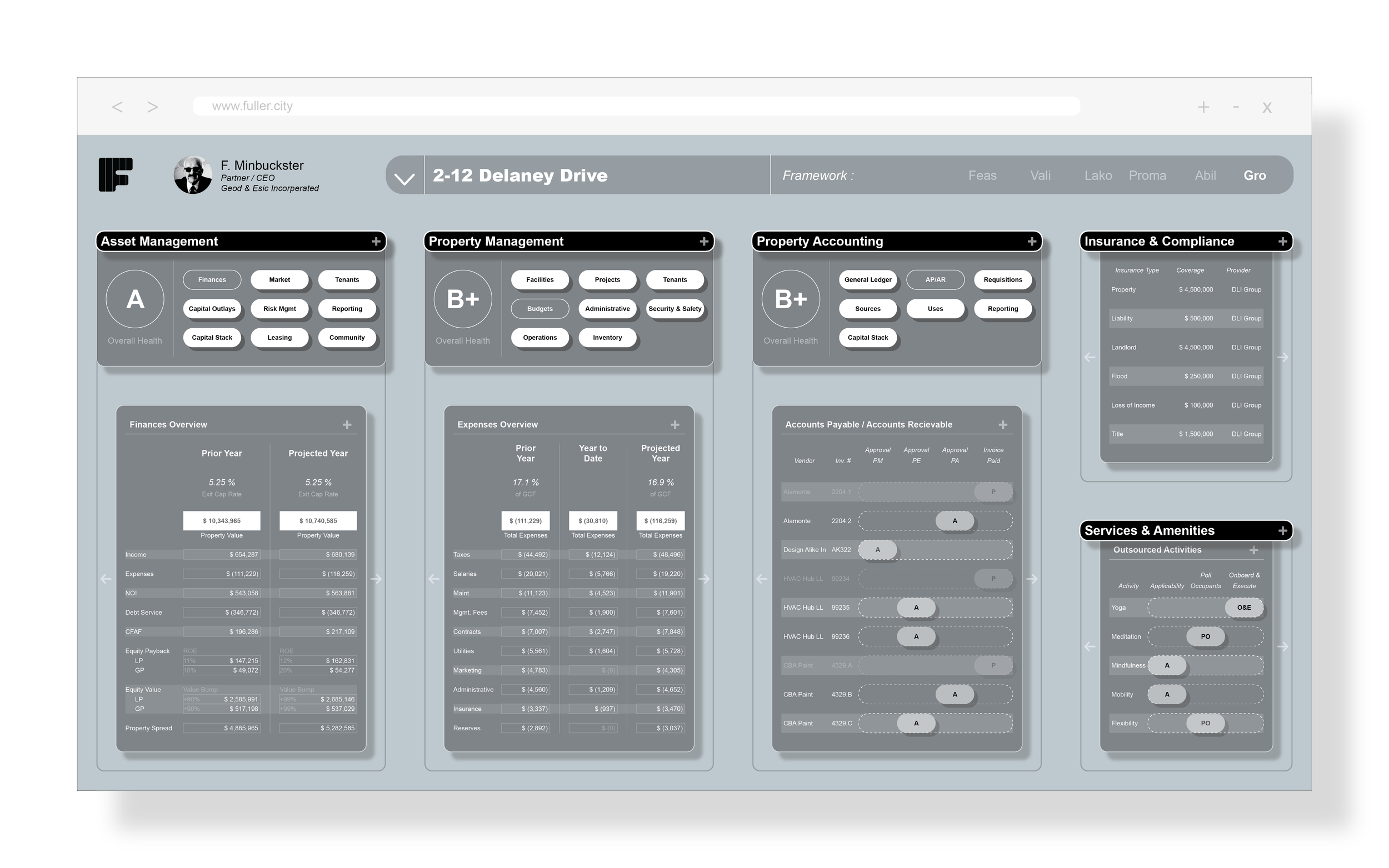

Gro

Project Optimization

Maximize asset performance through data-driven operations and financial oversight.

Gro turns properties into high-performing assets by integrating asset management, property operations, financial tracking, and risk management. With real-time insights and automation, optimize efficiency, reduce costs, and unlock long-term value across your portfolio.